InterOpera completes World Bank bond tokenisation exercise with industry observers

PR Newswire

09 Dec 2022, 08:53 GMT+10

Building greater financial inclusion through the democratisation of bonds as an asset class

SINGAPORE, Dec. 9, 2022 /PRNewswire/ -- Singapore-based digital infrastructure technology provider, InterOpera, has completed a World Bank bond tokenisation exercise to showcase how advanced blockchain technology can be applied to capital markets products. Alongside IFC (a member of the World Bank group), the observers and participants include global financial institutions and issuers such as BOC, CIMB, DBS, HSBC and KB Securities.

This exercise marks a step forward in realising InterOpera's mission of creating greater financial inclusion through the democratisation of capital markets products (such as bonds) and their digitalised forms as an asset class. The tokenised supranational bonds were made available to Singapore-based investors via a mobile platform, providing investors easy access to high-quality supranational bonds for a minimal sum of US$100. The benefits of applying innovative technology to the traditional processes of facilitating bond trading, include automatic order-taking, instantaneous transfer or exchange of security tokens and fiat tokens, with the promise of peer-to-peer and free-of-payment exchanges in the near future. The bonds that were tokenised are backed by real-world securities issued by International Bank of Reconstruction & Development (IBRD) and safeguarded by a licensed financial institution, thereby ensuring the highest level of investor protection.

For InterOpera, this exercise comes on the back of the successful conclusion of Project Genesis 1.0, a prototype delivered to a mandate issued by the Bank for International Settlements (BIS) and the Hong Kong Monetary Authority (HKMA), which provides for the tokenisation of digital green bonds for retail investors. The prototype was delivered by members of the InterOpera group, as the Liberty consortium, with Standard Chartered Bank and SC Ventures. Shareable Assets Pte. Ltd. is a wholly-owned subsidiary of InterOpera, which holds a capital markets services licence issued by the Monetary Authority of Singapore (MAS). The report for Project Genesis 1.0 can be downloaded here from the BIS website.

Founder and Chairman of InterOpera, Will Lee said, "This World Bank bond tokenisation exercise is timely in 2022, as it demonstrates the real-life commercial viability of an interoperable infrastructure platform or ecosystem, fully architected on blockchain, as a step forward to digitally transform the capital markets. Since delivering the prototype we showcased in Project Genesis 1.0, InterOpera has relentlessly innovated and developed its blueprint for such digital infrastructure to enable our financial institutions to 'securitise' complex financial instruments and traditional forms of assets as digital or intangible assets. This can greatly allow for more effective distribution, integrate and accommodate new, emerging forms of digital assets into the existing regulatory frameworks. We will continue to work tirelessly with our institutional partners to bring such ecosystem-enabling solutions to market."

Disclaimer: This press release has not been reviewed by the Monetary Authority of Singapore (MAS). No part of this content amounts to any form of legal, financial or investment advice and must not be relied upon as such.

For more information, please contact:

June Kwek

[email protected]

About InterOpera

InterOpera is a Singapore-based infrastructure technology company that provides distributed ledger technology infrastructure for capital markets and carbon trading markets. Its wholly-owned subsidiary, Shareable Assets Pte. Ltd., holds a capital markets services licence issued by the Monetary Authority of Singapore. Key investors include Vertex Holdings (backed by Temasek), Korea Investment Partners and Kakao Investment.

InterOpera sees the future of capital and carbon trading markets as one that is fully interconnected and built on blockchain-powered infrastructure technology, from which new industry standards are continually created. This is demonstrated by collaborations undertaken by InterOpera with the Bank for International Settlements (BIS), the United Nations Framework Convention on Climate Change (UNFCCC) and the Hong Kong Monetary Authority (HKMA).

For more information, please visit: https://www.interopera.co/. Connect with us on https://www.linkedin.com/company/interopera/ and https://twitter.com/interoperagroup.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Asia Bulletin news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Asia Bulletin.

More InformationInternational

SectionTrump administration pushes food firms to drop artificial dyes

NEW YORK CITY, New York: The Trump administration is pressuring major food companies to remove artificial dyes from their products,...

Lawmakers debate military expansion amid European security fears

BERLIN, Germany: German Lawmakers are debating whether to loosen the country's strict borrowing rules to fund military expansion. ...

Trump to end U.S. government international news services

The Voice of America may not live up to its ambitious name for much longer. Michael Abramowitz, the director of VOA, said in a Facebook...

Dozens dead as U.S. launches large scale offensive in Yemen

WASHINGTON, DC - U.S. President Donald Trump has joined Israel's war on Yemen's Houthis, days after the group said it would resume...

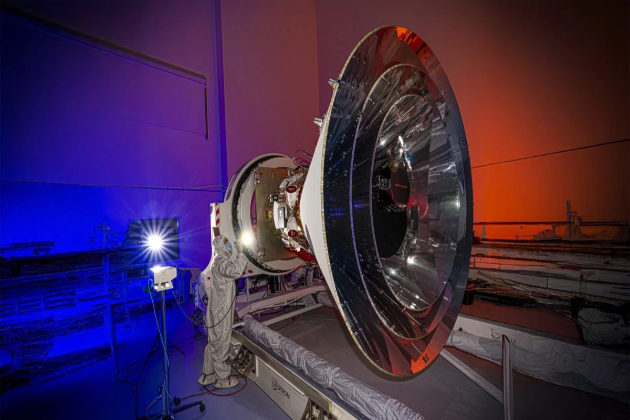

SPHEREx telescope to create a three-dimensional map of the cosmos

LOMPOC, California: NASA launched a new telescope into space this week to study the origins of the universe and search for hidden water...

Texas, New Mexico report 28 new measles cases in five days

AUSTIN/SANTA FE: Texas/New Mexico have reported 28 new measles cases in the past five days, bringing the total to 256 since the outbreak...

Business

SectionDollar General warns of slowing sales amid economic strain

GOODLETTSVILLE, Tennessee: Dollar General is bracing for a challenging year ahead, forecasting weaker-than-expected sales and profits...

Intel stock jumps 15% as Lip-Bu Tan named CEO

SANTA CLARA, California: Intel's stock soared nearly 15 percent this week following the announcement that former board member Lip-Bu...

UAW files labor complaint as Volkswagen cuts Tennessee production

DETROIT, Michigan: Volkswagen's decision to scale back production at its Chattanooga, Tennessee plant has sparked backlash from the...

Spotify paid a record $10 billion in music royalties in 2024

STOCKHOLM, Sweden: Spotify set a new milestone in 2024, paying out US$10 billion in royalties—the highest annual payout to the music...

Jaguar Land Rover opts out of EV production at Tata’s India plant

NEW DELHI, India: Jaguar Land Rover (JLR) has decided against manufacturing electric vehicles at Tata Motors' upcoming $1 billion factory...

Virgin Group aims to raise $900M for cross-channel rail venture

LONDON, U.K.: Virgin Group is seeking to raise $900 million to fund its plan to launch cross-channel rail services, positioning itself...