VCs under the top 2 banks in Thailand invest in Forward DeFi

PR Newswire

12 Sep 2022, 06:30 GMT+10

Latest: Venture capital arms under 2 leading Thai banks, Kasikornbank PCL (SET: KBANK) and Bank of Ayudhya PCL (SET: BAY) participate in the funding round to support the innovation of Decentralized Finance (DeFi).

BANGKOK, Sept. 12, 2022 /PRNewswire/ -- Forward, a Thai digital asset and blockchain startup focusing on protocol development for decentralized derivative exchange and DeFi platform, has successfully closed its USD 5 million seed round within just 6 months of fundraising, despite severe economic uncertainty and high volatility in the digital asset landscape.

The round was led by RPVAF-1, a global VC fund under Primestreet Capital, with participation from

- Beacon Venture Capital from Kasikornbank;

- KASIKORN X from Kasikornbank;

- Krungsri Finnovate from Bank of Ayudhya, a member of the Mitsubishi UFJ Financial Group (MUFG); and together with Ratanakorn Technology Group, GBV Capital and Varys Capital who have confirmed their investments earlier in this round.

Chanon Charatsuttikul, Co-founder and CEO of Forward, revealed that Forward is the world's first DeFi project to receive investments from global funds and two major Thai banks. "I believe that there is hope for Thailand to become a center of innovation and technology. We have investors who are ready to support new talents. The closing of this seed round, for me, is the beginning of a big challenge for the team to maximize our potential and grow the organization, and help make Thailand stand out as a country of innovation, just like western countries.

"The majority of trading volume occurs at Binance, the world's largest crypto exchange, and it mainly comes from derivative products. The trading volume of derivative products is approximately 3 times larger than the spot volume and it is still growing. Thus, Forward is focusing on developing a decentralized derivative platform, which is non-custodial with a system that prohibits transactions from sanctioned countries and addresses. We have a strong team backed by PhDs working day and night to develop a newly invented protocol, called the Automated Position Hedger (APH), which is unlike anything seen before. In addition, we always take it very seriously in terms of legal issues, accounting standards, and the safety of the investors' assets," Chanon added.

Asst. Prof. Dr. Udomsak Rakwongwan, Co-founder and Advisor, added that "We aim to develop Forward to be a 'One Stop Service' protocol, solving limitation and pain points in DeFi economy. It will be a secure and easy-to-use platform where users can earn sustainable investment returns. This means that the return generated to investors is a result of a solid and sustainable business model that was carefully designed for long-term operation. Our user-friendly interface will reduce the barrier to onboard new users to the blockchain space. For every single line of our coding, smart contract technical auditing is required and it will be performed by at least 2 trusted auditors."

Supavat Nam Cholvanich, Co-founder and Partner of PrimeStreet Capital, the lead investor of this round, said: "With our finance background, we have a good interest in financial-related blockchain technology. Digital asset is a high volatility landscape, and we highly emphasize the importance of safety and sustainability of the protocol. Our team focus deeply on the tightness of all operating logic and, at the same time, look for a platform with meaningful enhanced features that has the potential to stand out and elevate DeFi ecosystem. We believe Forward is well set up and its DeFi platform should easily navigate through market volatility and grow sustainably in the digital asset world."

About Forward

Forward is a digital asset and blockchain startup, founded by a group of developers and tech researchers. The founders' prior success was the launch of a well-known regulated crypto exchange in Thailand. Forward is currently developing a newly invented protocol for decentralized derivative trading, where short and long positions are matched against each other using an advanced protocol named Automated Position Hedger (APH). Forward DDEX acts as a counterparty to instantly match users' long and short perpetual Futures orders. As a result, Forward does not have limit order books and does not require market makers. The risk of the platform acting as a users' counter-party is completely hedged using the tokens in the lending and borrowing pools.

About Primestreet Capital

Primestreet Capital is a Southeast Asia-based global fund management company with a current AUM of USD150 million. The firm manages three flagship funds, including real estate PE, growth PE, and global VC. The RPVAF-1, its global VC fund, has invested in several impact technology companies around the globe.

SOURCE Forward

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Asia Bulletin news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Asia Bulletin.

More InformationInternational

SectionTexas, New Mexico report 28 new measles cases in five days

AUSTIN/SANTA FE: Texas/New Mexico have reported 28 new measles cases in the past five days, bringing the total to 256 since the outbreak...

NTSB urges FAA to restrict helicopters near Reagan National Airport

WASHINGTON, D.C.: U.S. Transportation Secretary Sean Duffy announced that helicopters will be permanently banned from flying near Washington...

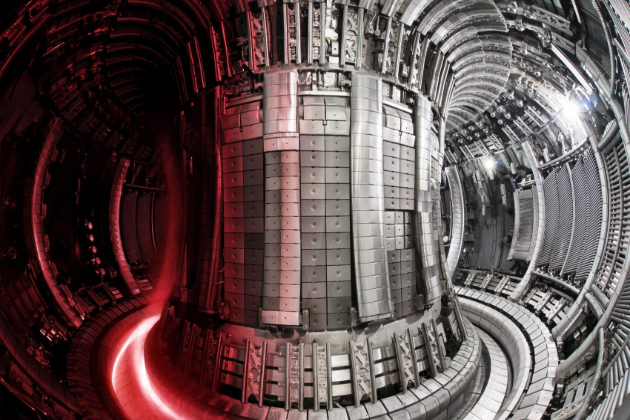

Virginia governor warns US must fast-track fusion or fall behind China

NEW YORK CITY, New York: The U.S. must accelerate its efforts to develop fusion energy or risk losing its edge to China, Virginia Governor...

China now dominates shipbuilding; US faces security risks

WASHINGTON, D.C.: In the past 20 years, China has become the world's top shipbuilder, producing more than half of all commercial ships....

New York fires 2,000 prison guards after wildcat strike

ALBANY, New York: New York fired over 2,000 prison guards this week for not returning to work after a weeks-long strike that disrupted...

China hits Canadian agriculture with tariffs in trade retaliation

BEIJING, China: China has announced new tariffs on Canadian agricultural and food products in retaliation for Canada's recent duties...

Business

SectionVirgin Group aims to raise $900M for cross-channel rail venture

LONDON, U.K.: Virgin Group is seeking to raise $900 million to fund its plan to launch cross-channel rail services, positioning itself...

Boeing's February deliveries surge to 44, up from 27 last year

SEATTLE, Washington: Boeing saw a significant increase in aircraft deliveries in February, reporting 44 planes delivered compared to...

Southwest ends free checked bags, introduces new fees

DALLAS, Texas: Southwest Airlines will start charging passengers for checked bags, ending a long-standing policy that set it apart...

U.S. stocks rally hard despite drop in consumer sentiment

NEW YORK, New York - U.S. stocks rallied hard on Friday, boosted by strong rises around the world. Investors shrugged off a decline...

Maserati cancels electric MC20 plans over low demand

MILAN, Italy: Maserati has scrapped plans for an electric version of its MC20 sports car, citing low expected demand for the high-performance...

Volkswagen to slash 1,600 jobs at Cariad by year-end

BERLIN, Germany: Volkswagen is set to cut 1,600 jobs at its Cariad software division by the end of the year, affecting nearly 30 percent...